The Bank of Stockton, founded in 1867, stands as a beacon in the world of finance—a true testament to resilience and adaptability. From its humble beginnings, this iconic financial institution has navigated countless financial storms, evolving with the times while staying true to its community mission. The vision of its founders was to create a banking institution that not only serves but also empowers the local populace. Throughout the years, whether through economic downturns or technological transformations, the Bank of Stockton has consistently found ways to strengthen its foundation and pursue innovation.

The milestones that have punctuated its journey illuminate how the bank has become a pillar in the Stockton area. Remarkably, it has transformed challenges into opportunities, fostering relationships and building trust within the community it serves. To understand the extraordinary legacy of success that this bank represents, we need to explore pivotal moments that have solidified its reputation as a pioneering institution.

The Rise of Bank of Stockton: A Journey Through History

The history of the Bank of Stockton is painted with ambition, perseverance, and a commitment to serve. Founded after the California Gold Rush, the bank catered to mining communities and aspiring entrepreneurs. The founders aimed to create a safe haven for deposits, which fueled local businesses, thus significantly uplifting the economy of Stockton.

Throughout the latter part of the 1900s, the Bank of Stockton weathered various financial crises, including the Great Depression. Its ability to remain solvent showcased not only its effective risk management strategies but also its dedication to customer service. During significant national downturns, the bank adapted its policies and practices, reinforcing its commitment to community-based banking.

Keeping pace with technological advances, the Bank of Stockton gradually embraced innovation, which played a significant role in its expansion and relevance. By understanding not just the financial landscape but also the needs of its customers, the bank fortified its position as a local banking leader.

Top 5 Milestones in the Success of Bank of Stockton

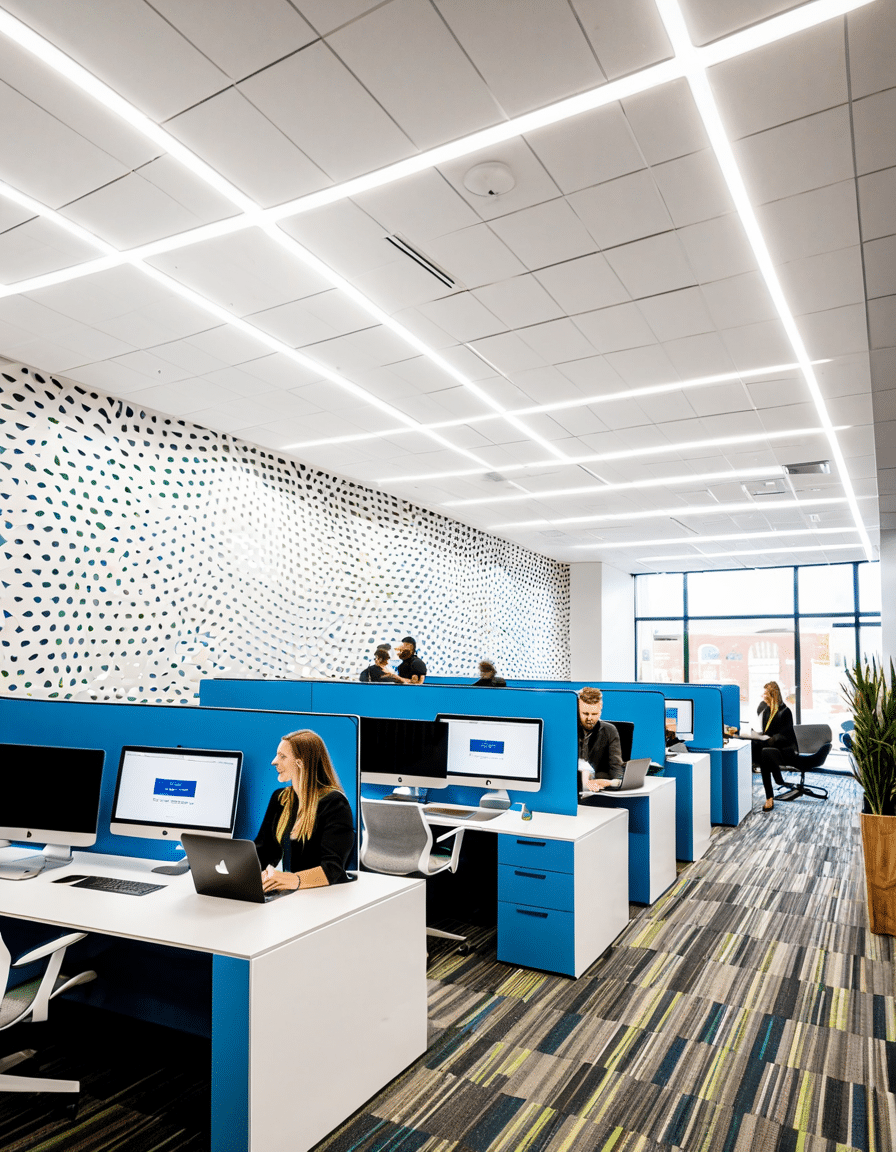

In the early 2000s, the Bank of Stockton took a significant leap by introducing online banking services. This move made it easier for clients, especially younger generations, to perform transactions conveniently. As a pioneer in digital banking, it set the stage for other local banks to follow suit.

The establishment of the Bank of Stockton Community Fund underscored its commitment to enriching the community. The bank has championed various initiatives, including financial literacy programs, empowering individuals to manage their finances better. These efforts have fostered a reputation that emphasizes corporate responsibility.

In 2010, the bank made waves by acquiring Travelers Inn, significantly diversifying its offerings and extending its reach. This strategic acquisition revealed the Bank of Stockton’s ambition, aiming to meet the broader needs of its clients, from individuals to businesses.

The 2008 financial crisis tested many banks, but the Bank of Stockton emerged resiliently. It implemented stricter lending criteria and sharpened its risk management focus. By prioritizing community lending, the bank managed to maintain credibility while navigating turbulent financial waters.

The Bank of Stockton’s innovative practices haven’t gone unnoticed. Local publications have repeatedly honored it with the title of “Best Local Bank.” Such accolades signify the institution’s commitment to quality service and a positive reputation among its clients.

The Impact of Community Banking on Local Economies

Community banks like the Bank of Stockton significantly contribute to the economic fabric of their regions. Through financial support tailored to local businesses, the bank fosters entrepreneurship and innovation. By offering loans that cater specifically to community needs, both big and small, this institution creates a nurturing environment for economic growth.

Furthermore, the bank plays an essential role in housing developments by financing residential projects that provide essential homes for Stockton residents. This involvement creates jobs and pushes forward the economy, proving that successful banking goes hand-in-hand with community well-being.

Ultimately, by championing local entrepreneurs and supporting community initiatives, the Bank of Stockton has cultivated a robust ecosystem that promotes sustainable economic growth. Its impact resonates through the very foundations of the Stockton area, creating a legacy that others hope to emulate.

The Future Vision: Continuous Innovation at Bank of Stockton

Innovation at the Bank of Stockton doesn’t just stop at online banking. As we venture deeper into the digital landscape, the bank continues to broaden its horizons by incorporating AI-driven financial advisory services. These modern technological advancements promise personalized banking experiences that align with contemporary consumer expectations.

Interviews with key executives reveal an exciting vision for the future: a commitment to not just keep pace with changes but to lead the charge. Enhanced cybersecurity measures are being prioritized, ensuring that customers can trust their sensitive information is secure as they navigate digital banking solutions.

The bank’s foresight in continuously innovating will be vital as competition intensifies in the marketplace. It embodies the saying, “The sky’s the limit,” as it explores fresh avenues to stay engaged with its clients while providing the support they need.

Banking in a Post-Pandemic World: Lessons Learned

The COVID-19 pandemic altered numerous landscapes, and banking was no exception. The Bank of Stockton swiftly adapted by initiating remote operations and enhancing its customer service protocols. This not only retained existing clients but also attracted new customers looking for reliable banking during uncertain times.

Lessons learned during the pandemic highlighted a shift in customer expectations. People now place a premium on convenience, creating a call for banks to transform their services further. The Bank of Stockton appreciates these changes and is keen to adapt its practices to meet evolving client demands.

Ultimately, the pandemic served as a catalyst for change, with the Bank of Stockton emerging stronger and more resilient than ever. Clients have gained newfound trust in their banking practices, paving the way for continued success.

Building a Sustainable Future: Corporate Responsibility Initiatives

In an age where consumers prioritize sustainability, the Bank of Stockton stands at the forefront of environmentally conscious banking. Efforts to reduce its carbon footprint, such as promoting paperless operations, underscore its commitment to sustainable practices.

Moreover, the bank finances green projects, supporting initiatives that focus on environmental conservation. This proactive approach to corporate responsibility is increasingly prevalent in today’s corporate climate, and the Bank of Stockton is showcasing how banking can align with sustainable practices.

By integrating sustainability into its business model, the Bank of Stockton positions itself to tackle future challenges while upholding its values of community service and responsible banking.

The Legacy of Bank of Stockton: A Model for Financial Excellence

The legacy of the Bank of Stockton is a shining example of how merging traditional banking values with modern innovation can yield remarkable success. Through its vigilant community-focused approach, the bank has built a strong foundation that resonates with both local clientele and the broader financial landscape.

In an era marked by rapid change, the Bank of Stockton’s commitment to quality service combined with its visionary mindset exemplifies how financial institutions can thrive. This blend of community-centric practices, adaptive strategies, and forward-thinking initiatives ensures that the Bank of Stockton won’t just succeed today but will continue to inspire for generations to come.

Overall, the Bank of Stockton encapsulates what it means to be a leader in banking—one that thrives on community connections, embraces change, and stays resolute in its commitment to excellence. As it marches forward into the future, the institution remains a shining beacon for local banking, proving that a legacy built upon trust, innovation, and social responsibility can pave the way for financial success.

Bank of Stockton: Fun Trivia and Interesting Facts

A Legacy of Service and Community

Did you know the Bank of Stockton has been a cornerstone of financial stability since its founding in 1867? This long-standing institution provides more than just banking services; it’s woven into the fabric of the community. With over a century in business, the Bank of Stockton has become synonymous with trust and reliability, much like the way the Peru national football team Vs Chile national football team Stats showcase the fierce loyalty fans have for their teams.

Another fun fact: the Bank of Stockton was among the first banks in California to offer extensive loan applications that cater to local needs. These loan Apps have evolved over time, reflecting advances in technology while maintaining a personal touch that customers love. It’s this blend of tradition and innovation that keeps folks coming back.

More Than Just Banking

The Bank of Stockton has helped countless families start their journeys—from home purchases to personal savings. But did you know it’s also played a vital role in supporting local businesses? Many entrepreneurs have found inspiration and support through the bank, much like how a catchy Pointing meme can grab attention on the internet. The community knows they can rely on this bank, fostering growth right where it matters.

Speaking of growth, the bank has also contributed to health and welfare initiatives in the area, partnering with organizations like Lds Hospital to provide essential services. This reflects a commitment to not just financial success but overall community well-being—something we should all aspire to!

A Name to Remember

Lastly, did you ever think about how names stick in our memories? The Bank of Stockton has a catchy name that resonates with many, similar to captivating characters like Romeo Jon bongiovi in pop culture. Additionally, despite its historical roots, the bank has embraced modernization, making it possible for clients to manage their finances like watching the latest Donnie Wahlberg Movies And TV Shows—easy, engaging, and on-demand.

In wrapping up, the Bank of Stockton’s impressive legacy isn’t just about financial transactions; it’s interlinked with community spirit and a passion for progress. As you can see, there’s so much more to this institution than meets the eye! Whether it’s finances or fun facts, this bank keeps everyone on their toes! Don’t forget to check the Clima de 10 Días para Newark before you visit, just in case the rain decides to put a damper on your day!