First Franklin Financial has emerged as a titan in the lending sector, constantly innovating and adapting to the needs of its customers. With their exceptional blend of technology and consumer insights, they’ve reshaped how we think about borrowing money. In a world where financial decisions can be overwhelming, First Franklin Financial stands out by providing creative lending solutions tailor-made for today’s borrower. So, what are the game-changing innovations they’re bringing to the table? Let’s dive right in!

Top 5 Innovations by First Franklin Financial in the Lending Landscape

First Franklin Financial isn’t just keeping up with industry trends; they’re setting them. Here are the top five innovations transforming how they do business:

Talk about cutting-edge! First Franklin Financial has taken a leap into the future with dynamic interest rate algorithms. These advanced machine learning models adapt to real-time market conditions, individual credit profiles, and borrower behaviors. By minimizing risk and maximizing lending opportunities, they can offer competitive rates. It’s like having a financial GPS that helps guide borrowers to the best possible outcome.

If you think you need a perfect credit score to get a loan, think again. First Franklin Financial is partnering with fintech leaders to bring you non-traditional credit assessments. They’re diving deep into unconventional data sources, like your utility and rent payment histories, expanding access to those who have been sidelined by old-school credit scoring methods. This is the kind of innovation that empowers borrowers to improve their financial standings.

Say goodbye to complicated paperwork! First Franklin Financial launched an easy-to-use digital application platform. This means you can apply for loans right from your couch (or anywhere, really). It even includes biometric security measures to protect your data, making it a safe, fast, and user-friendly experience. It’s not just lending; it’s lending reimagined for the digital age.

At First Franklin Financial, they believe in understanding the whole person—financially, emotionally, and psychologically. By integrating tools like the Clifton Strengths Assessment into their pre-loan consultations, they dive into applicants’ strengths. This way, they can curate personalized financial education resources that encourage responsible borrowing and give customers the confidence to make informed financial choices.

Goodbye long hold times! First Franklin Financial is deploying AI-driven analytics to predict customer service needs before they arise. This proactive support is a game changer, reducing resolution times and leaving customers delighted, especially during peak borrowing periods. Who would’ve thought that borrowing money could come with such impressive service?

How First Franklin Financial Leverages Wellness Concepts in Lending: The Role of Oracle Cards and Keeper Standards

First Franklin Financial is broadening their approach, weaving wellness concepts into their lending practices. Let’s explore how this unique perspective is not just about dollars and cents—it’s about enhancing client relationships too.

Integrating Oracle Cards in Financial Planning

No, Oracle cards aren’t just for tarot readings! First Franklin Financial uses these as metaphorical tools in their client interactions. Encouraging customers to express their feelings about money management through these cards fosters deeper conversations. This method enriches their understanding of personal financial behavior, leading to smarter borrowing decisions. It’s all about finding the emotional connection to improve financial outcomes—talk about innovative!

Emphasizing the Keeper Standards Test

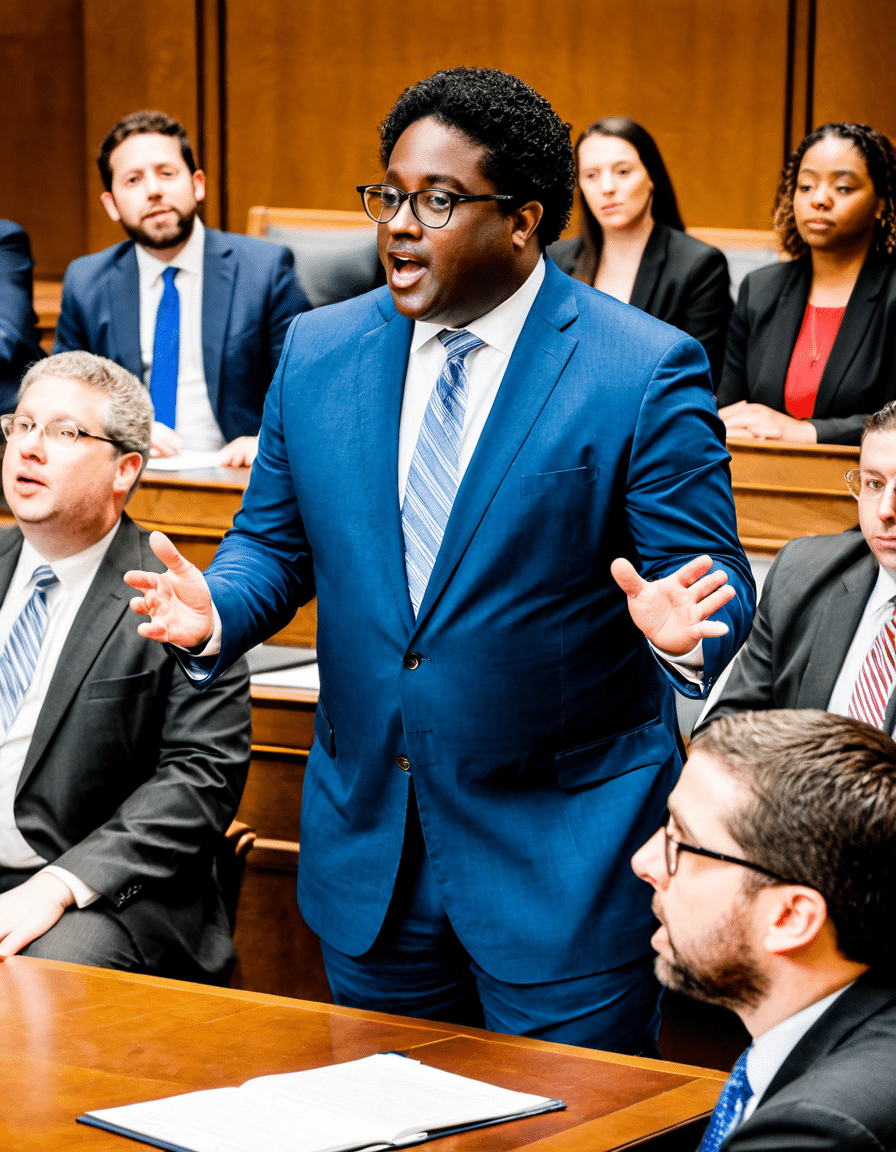

When you trust someone with your money, you want to make sure they’re solid, right? That’s where the Keeper Standards Test comes in. First Franklin Financial evaluates its lending staff against this test to uphold trust and accountability. Systematic assessments mean their team is not just knowledgeable but genuinely invested in helping customers succeed. It reflects their commitment to responsible lending.

Market Impact: Analyzing First Franklin Financial’s Progress in 2026

Fast forward to 2026, and the lending landscape has undergone a seismic shift. Thanks to their innovative strategies, First Franklin Financial has not only increased market share but also solidified brand loyalty amid rising consumer demands. Their customer-centric innovations have led to a significant drop in default rates, allowing them to adapt to current economic trends and regional financial health effectively.

By listening to their customers and evolving, First Franklin Financial has made a mark that’s hard to ignore. Their advancements indicate that the future of lending is bright, and they’re leading the charge. Imagine securing a loan with confidence, knowing you have a supportive partner along the way—it’s changing lives.

Innovating Beyond Tradition: The Future of Lending with First Franklin Financial

As we glance into the future, First Franklin Financial isn’t hitting the brakes; they’re pushing the gas pedal! They’re set on exploring new technologies like blockchain for secure transactions, aiming for an even more seamless experience for customers. They’re also eyeing partnerships with emerging fintech companies, continually enhancing personalization through improved data analytics.

These initiatives promise to redefine the borrowing experience, making it sharper and more intuitive. By merging behavioral insights with advanced technology, First Franklin Financial is not just leading the lending sector but is paving the way for sustainable financial practices. This isn’t just forward-thinking; it’s a movement towards financial well-being that empowers consumers at every level.

In a whirlwind of change, First Franklin Financial stands tall, challenging the status quo and ushering in a new era where lending is not just about transactions but about relationships and future growth. With their innovative tactics and human-centered approach, they’re setting a powerful example for the entire industry to follow.

In a nutshell, First Franklin Financial isn’t just about providing loans; they’re about creating a brighter, more inclusive financial future for everyone. Now, that’s something worth getting excited about!

Fun Trivia and Interesting Facts About First Franklin Financial

The Pioneering Spirit of First Franklin Financial

Did you know that the First Franklin Financial has roots dating back several decades? Founded in the 1980s, this company has always been at the forefront of innovative lending practices, adapting to the needs of its customers like a chameleon. A little-known fact is that they offer unique loan products tailored to fit borrowers’ various needs, much like how you can find free movies in Spanish that cater to diverse audiences on websites offering peliculas gratis en espanol. It’s all about making sure folks get what suits them best!

Financial Footprints and Innovations

As First Franklin Financial continues to evolve, they’ve made waves in the lending world by implementing technology that simplifies processes. Similar to how the popular character Eugene from The Walking Dead, known for his smarts and resourcefulness, innovates to survive, this financial institution has embraced digital trends. Their user-friendly platforms often draw comparisons to leadership in their spaces, as seen with the reliability of services accessing things like your ancestry.com login. Who knew a loan could feel as simple as logging into a family tree site?

Looking Toward the Future

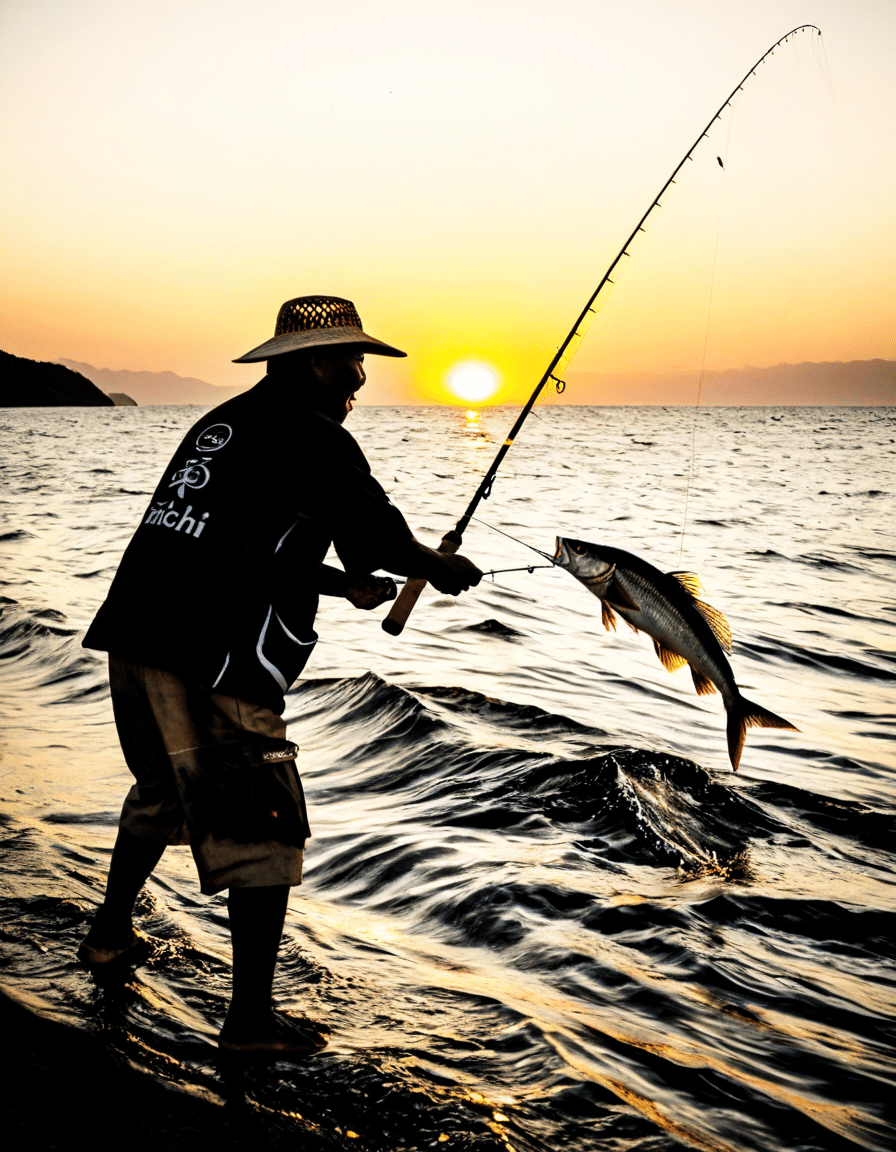

The future looks bright for First Franklin Financial as they advance their commitment to customer satisfaction. They believe that lending should be straightforward and accessible to everyone. Just like the care that goes into crafting a premium flight experience with united premium economy, this company ensures its services are comfortable and tailored. Engaging with their clients is a priority, and they make sure to offer support akin to how fan communities rally around beloved games, with discussions buzzing across platforms like fnaf r34. In essence, First Franklin Financial isn’t just about loans; it’s about creating a community where everyone feels supported and informed.