1. The Rise of Unifin in Financial Technology

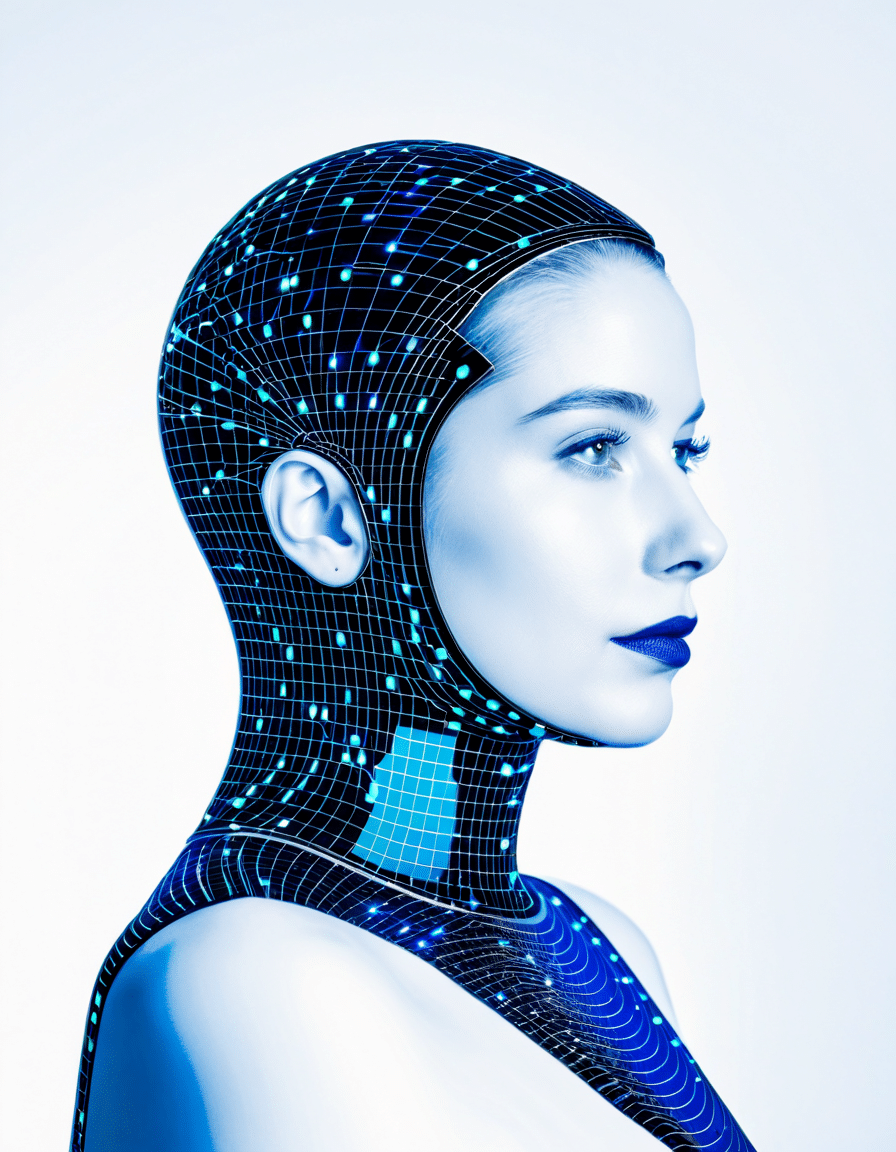

As we venture into the vibrant landscape of finance in 2026, Unifin stands out as a transformative force within the fintech sector. Its innovative approach to integrating technology into financial services has revolutionized how businesses manage their finances and interact with consumers. Just picture this: a world where businesses can tap into effective financial solutions at their fingertips, allowing them to make swift, informed decisions. By harnessing advanced technologies and data-driven strategies, Unifin has distinguished itself from traditional banking institutions, creating a niche that’s as refreshing as it is impactful.

From cutting-edge analytics to seamless transactions, Unifin’s influence has become undeniable. This company is pushing past the conventional boundaries of finance, empowering businesses and consumers alike with tools and resources that elevate their financial management experiences. As a result, financial landscapes are shifting tremendously—a trend that reflects Unifin’s commitment to innovation.

In a nutshell, this fintech powerhouse has harnessed the power of modern technology to create solutions that respond directly to market needs. The trajectory of finance is changing, and at the forefront of this evolution is Unifin.

2. Top 5 Innovative Solutions by Unifin Reinventing Finance

Unifin has taken finance and spun it on its head with five standout solutions that are redefining the rules:

2.1. Unifin’s Joi Database: A Game-Changer in Financial Analytics

The Joi Database is like the secret sauce for financial analytics, courtesy of Unifin. This state-of-the-art system blends artificial intelligence and big data, unlocking valuable real-time insights into consumer behavior. For instance, retailers harnessing the Joi Database have seen forecasting accuracy spike by 25%. This improvement isn’t just a number; it translates to smarter inventory management and happier customers. Imagine being able to predict what your consumers want before they even know it themselves!

2.2. Advanced Processing Solutions: Streamlining Transactions

Unifin’s advanced processing solutions are the unsung heroes of transaction management. They ensure businesses can handle transactions smoothly and securely, regardless of scale. For example, Trello adopted Unifin’s processing systems and sliced transaction times down from a tedious three days to near-instantaneous completion. This leap boosts user satisfaction and simplifies financial engagement, keeping customers coming back for more.

2.3. Automated Financial Advisory: Personalization at Scale

Imagine having a financial advisor in your pocket; that’s what Unifin’s automated advisory solutions provide. By utilizing predictive analytics and machine learning, these tools deliver personalized financial planning tailored to individual spending habits and financial goals. Major players, like Wealthfront, have jumped on board with similar models, showcasing how these innovations can empower clients while sidestepping the costly fees typically associated with personal finance management.

2.4. Blockchain Integration for Enhanced Security

In an era of rising cyber threats, Unifin recognizes that security is paramount. Its adoption of blockchain technology fortifies both transactions and data integrity, creating a shield against fraud. This move mirrors strategies embraced by institutions like JPMorgan Chase, further cementing the value of Unifin’s commitment to safety in financial dealings. The future of finance needs to be secure, and Unifin is paving the way.

2.5. Customer-Centric Mobile Applications: Finance at Your Fingertips

Unifin’s mobile applications are designed with the user in mind, offering intuitive interfaces that make navigating personal finances a breeze. Features such as expense tracking, budgeting tools, and investment monitoring are seamlessly integrated. Competing brands like Mint set the bar high, but Unifin has carved its space with enhanced interactivity and engaging gamification techniques, drawing in a younger demographic eager for smart financial tools.

3. The Future of Finance: Unifin’s Vision

Looking ahead, Unifin’s vision is crystal clear: revolutionizing finance for everyone. As they continue to innovate, there’s a push to develop sophisticated tools that ensure people from all walks of life can access the financial products they need. By investing heavily in AI, Unifin is primed to enhance the user experience further, funneling resources into underserved markets. This commitment is not just about profit; it reflects a broader movement towards democratizing finance, making financial services more inclusive.

Every milestone achieved adds to Unifin’s narrative of creating a better financial future. As businesses and consumers embrace technological advancements, Unifin is keen on paving pathways that lead to ease of access and efficiency. Exciting times lie ahead as this fintech trailblazer transforms financial services for the better and propels the industry forward.

4. Challenges Ahead for Unifin and the Fintech Sector

Despite its remarkable achievements, Unifin isn’t free from hurdles. The fintech sector grows increasingly competitive. One major concern is regulatory compliance, especially as governments around the globe ramp up regulations concerning data privacy and transaction security. Unifin must grapple with these evolving standards while maintaining its edge.

Moreover, the influx of new players in the market means differentiation is more critical than ever. Unifin needs to keep innovating to sustain its position. Without carefully navigating these challenges, they risk losing ground in what’s turning out to be a fiercely competitive environment.

5. Implications of Unifin’s Innovations on the Financial Sector

The ramifications of Unifin’s advances stretch far beyond its own platform, heralding a shift in the financial landscape. By focusing on user-friendly solutions and smart data usage, Unifin raises the bar for the industry. The implementation of tools like the Joi Database shows how data can significantly improve decision-making and operational efficiency in finance—a lesson all future businesses should take to heart.

In a world that’s moving fast, Unifin stands boldly at the cutting edge of innovation. All eyes are on how they’ll tackle challenges and seize opportunities in the future. With a commitment to making finance accessible, the potential for monumental growth and transformation in the sector remains thrillingly high.

In short, as businesses and consumers alike embrace these remarkable technological changes, Unifin is poised to play a pivotal role in driving the finance industry to new heights, all while setting a beat that others will strive to follow.

Unifin: Impacting Finance with Innovative Solutions

Fun Facts about Unifin

Did you know that Unifin isn’t just about finance; it also resembles the creative flair of the entertainment industry? Just like how Kanyes artistic vision has reshaped the music landscape, Unifin’s groundbreaking solutions are redefining the finance sector. With its distinct approach, the company elevates traditional finance processes while maintaining a service ethos that rivals even the best businesses out there.

Interestingly, Unifin’s versatility extends beyond just finance. Just like folks flying from the UK to India need to plan their journey carefully, Unifin helps businesses streamline their financial paths, making sure every decision is strategic and beneficial. This innovative mindset mirrors the thought behind sweet Peppers, often overlooked yet packed with health benefits—proof that the right twist can make all the difference!

Unifin and Its Innovative Edge

Now, if you think about creativity in finance, it’s not too different from the artistic efforts of Eddie Bracken in classic cinema: sometimes you need to think outside the box! Unifin draws inspiration from various fields to innovate, showcasing that finance doesn’t have to be mundane. And speaking of creativity, one might sip mushroom tea to spark ideas, revealing how everyday sources can inspire profound advances.

As Unifin continues to evolve, their fine-tuned services remind us of the excitement surrounding trendy releases, much like the anticipation for new Adidas Sambae sneakers. In the world of finance, staying ahead often means understanding market shifts and adjusting approaches—just as Mike bloomberg once noted,In business, timing is everything. It’s this blend of sharp insight and tailored solutions that allows Unifin to cater to a diverse clientele, proving that finance can be as zingy as a dish seasoned with lemon verbena.

So, whether you’re optimizing your finances like planning a smooth trip or searching for groundbreaking ideas over a cozy cup of tea, remember that Unifin’s approach is as noteworthy as any juicy trivia you can dig up.