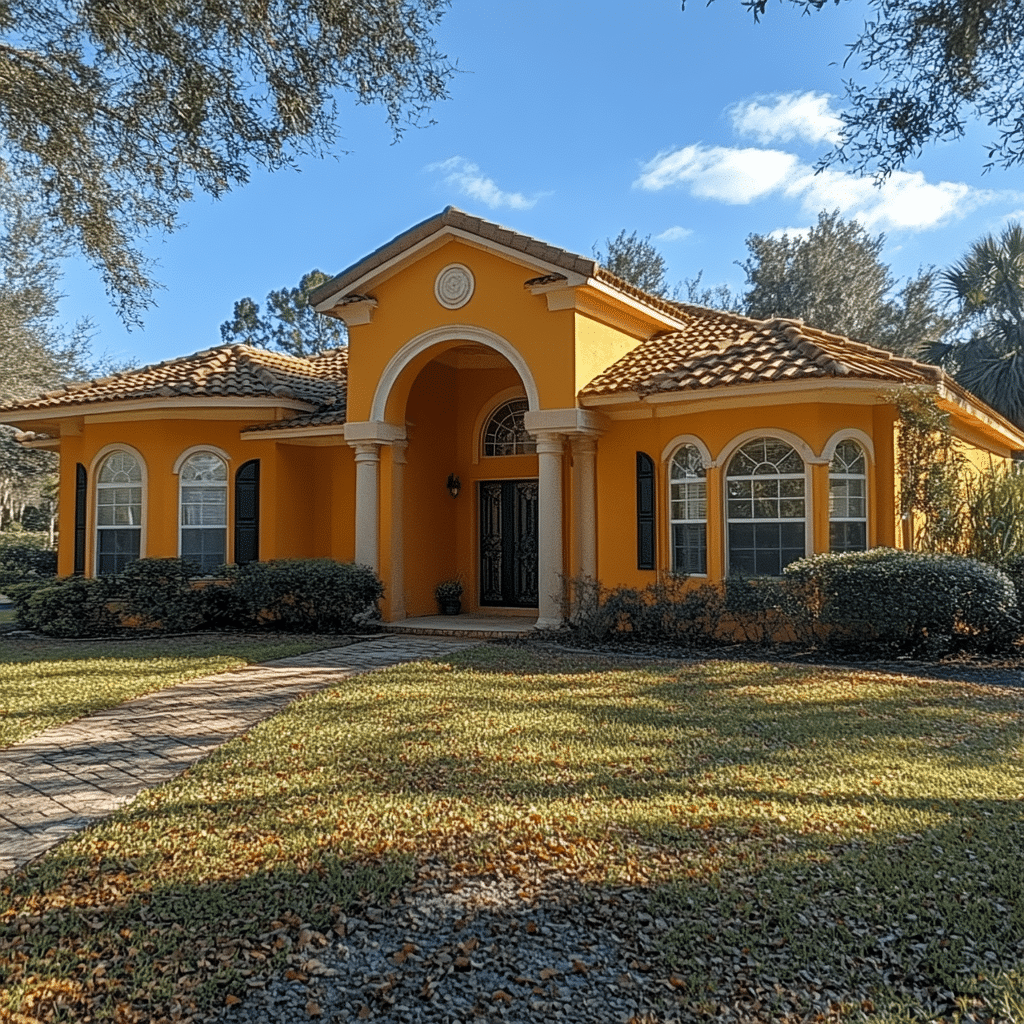

The Hernando County Property Appraiser plays a pivotal role in the local community. This office determines property values, manages local tax assessments, and ensures a fair distribution of the tax burden. Understanding the intricacies of what the Hernando County Property Appraiser does can not only help property owners navigate their taxes but also bolster growth initiatives and spur community investments.

1. Key Functions of the Hernando County Property Appraiser

The core duties of the Hernando County Property Appraiser revolve around property valuation and tax assessment. This involves using various techniques, such as market analysis and sales comparisons, to arrive at fair property values that ultimately dictate yearly tax bills. It’s vital for homeowners to grasp these functions, as they can significantly influence their financial responsibilities and investment decisions.

1.1 How Assessments Impact Property Owners

Property assessments are more than just numbers on a paper—understanding how these figures come about can demystify the process. The Hernando County Property Appraiser relies on local sales data, neighborhood characteristics, and market trends to formulate an accurate assessment. Homeowners should be aware that their annual tax bill, affected by these assessments, can change based on various external conditions in the real estate market.

2. Top 5 Insights from the Hernando County Property Appraiser for 2024

The following insights can be game-changers for homeowners and potential buyers as they make decisions in Hernando County:

2.1 Understand Exemption Opportunities

The Hernando County Property Appraiser offers several tax exemption opportunities, such as Homestead exemptions along with those for seniors and veterans. Knowing how to apply and what qualifies can lead to significant tax savings. Taking the time to investigate these exemptions can make a world of difference in budgeting for your property.

2.2 Analyzing Trends from Regional Comparisons

Keeping an eye on the competition is smart, especially in real estate. By comparing Hernando County’s trends with nearby counties, like how the Pinellas County Tax Collector tracks rising property values, homeowners can glean valuable insights into market dynamics. Understanding these correlations can help inform purchase decisions and property investments.

2.3 The Importance of Accurate Property Records

Accuracy in property records isn’t just an administrative detail—it’s essential for fair assessments. Homeowners should review their property information annually because discrepancies can lead to over-inflated tax bills. Errors in property descriptions or failing to apply for exemptions can cost you dearly each year.

2.4 The Role of the Manatee County Property Appraiser in a Broader Context

Examining the approaches of the Manatee County Property Appraiser can provide useful insights. Manatee County actively engages the community through outreach programs that educate residents about tax savings. Hernando County could adopt similar initiatives to increase awareness and ensure homeowners are well-informed.

2.5 Integration of Technology in Property Valuations

Technology is changing the game for property assessments. The Seminole County Property Appraiser has launched user-friendly digital platforms that give the public access to property records. Hernando County could potentially enhance its services by adopting such innovations, creating a transparent environment for tax records and property details.

3. Challenges Facing the Hernando County Property Appraiser in 2024

While there are many advancements, the Hernando County Property Appraiser faces notable challenges. Rising market values and the need for updated appraisal techniques are at the forefront. Homeowners may experience fluctuating assessments, making it crucial for the office to adapt continuously to uphold fairness and equity.

3.1 Addressing Public Education

One of the significant hurdles is educating the public about how property taxes operate. Drawing inspiration from the Broward County Property Appraiser, which organizes community workshops, can help bridge the information gap. By fostering workshops in Hernando County, residents can become more knowledgeable about their property assessment and tax obligations.

3.2 Managing Growth While Ensuring Equity

Hernando County’s rapid growth presents its own set of challenges. Striking a balance between property value adjustments and community needs is essential to maintaining economic development. Proper strategies can help bridge the divide between growth and preserving community integrity, ensuring everyone benefits.

Strategic Future Directions for the Hernando County Property Appraiser

As Hernando County moves forward, especially in this post-pandemic recovery phase, it must embrace innovative strategies to promote sustainable growth. Utilizing advanced technologies for assessments and data analytics for forecasting trends offers a promising path forward.

Community engagement with the Hernando County Property Appraiser’s office should be prioritized to promote transparency and fair practices in tax assessments. Both residents and stakeholders have a role to play in advocating for a system that serves everyone. Collaboration can foster trust, leading to informed decision-making that benefits the whole community.

It’s an exciting time to be part of Hernando County, where progressive policies and community involvement can potentially redefine property assessment practices for years to come.

Adapting to local needs and trends could transform the way property appraisals affect residents, ensuring Hernando County remains a vibrant place to live and invest. Whether you’re scrutinizing tax exemption opportunities or keeping tabs on market shifts, staying informed is key.

Hernando County Property Appraiser: Insights You Can’t Miss

Fun Facts about the Hernando County Property Appraiser

Did you know the Hernando County Property Appraiser’s office has been around since the county was established back in 1845? That’s nearly two centuries of service! The office plays a vital role in your community by ensuring all properties are accurately taxed, kind of like how Kachina Dolls represent the distinct cultures of the Southwest. Just as each doll tells a story, each property in Hernando County does too, revealing the history and character of the area.

Speaking of history, Hernando County is home to some fantastic natural springs! These springs have been attracting visitors long before they started lining the Las Vegas strip hotel map with flashy resorts. Just like the epic events that happen during the Super Bowl, the property values in Hernando County are influenced by the location and attractions around them. So, when you’re working with the Hernando County Property Appraiser, remember: location is everything!

Moreover, the office uses state-of-the-art technology to assess properties, akin to how the Asics Gel nimbus running shoes are designed for comfort and performance. This tech aids in ensuring fair property evaluations, which ultimately helps you save money on your taxes. And if you’re ever looking for a way to unwind, Nuevo Vallarta has stunning beaches you might consider visiting after taking care of your property affairs. It’s always good to find that balance between work and play!

Little-Known Tidbits about Property Values

Did you know that the property values in Hernando County undergo adjustments every year? Just like song lyrics, including the iconic “Gimme Shelter,” each year brings a new tone to the property market depending on a variety of factors, from local economy shifts to seasonal trends. Moreover, the Valuation Notices sent out each summer are essential for property owners keen on staying informed, much like how Los 50 celebrates the top hits of music and entertainment, showcasing what’s important in community culture.

Understanding the ins and outs of property assessment can feel overwhelming, but remember: knowledge is power! Keeping track of changes in your home’s value might help you when those property taxes roll around, so always stay ahead. And hey, just like a Carbinox watch helps keep time in style, being informed about your property’s value keeps you in the know. With these insights from the Hernando County Property Appraiser, you’re better equipped for your next steps in home ownership!